The more customers she serves, the more food and beverages she must buy. These costs would be included when calculating the contribution margin. The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis.

Business Cards

Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows. The contribution margin helps companies to evaluate the profitability of individual products, services or business areas. By determining the contribution margin, a company can determine which products are profitable and which are not.

Operating Assumptions

Such fixed costs are not considered in the contribution margin calculations. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price the 16 best marketing strategies for small businesses planning for products. A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit.

Calculate Contribution Margin Ratio

While contribution margin is expressed in a dollar amount, the contribution margin ratio is the value of a company’s sales minus its variable costs, expressed as a percentage of sales. However, the contribution margin ratio won’t paint a complete picture of overall product or company profitability. The contribution margin is a key business figure that indicates how much a company contributes to covering fixed costs and making a profit by selling its products or services. It is calculated by deducting the variable costs from the sales revenue generated. To understand how profitable a business is, many leaders look at profit margin, which measures the total amount by which revenue from sales exceeds costs.

Does the Contribution Margin Calculation include Services Revenue?

- Calculating your contribution margin helps you find valuable business solutions through decision-support analysis.

- Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies.

- For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage.

- The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products.

The formula to calculate the contribution margin is equal to revenue minus variable costs. Profit margin is calculated using all expenses that directly go into producing the product. For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it. Before making any changes to your pricing or production processes, weigh the potential costs and benefits. The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale. It offers insight into how your company’s products and sales fit into the bigger picture of your business.

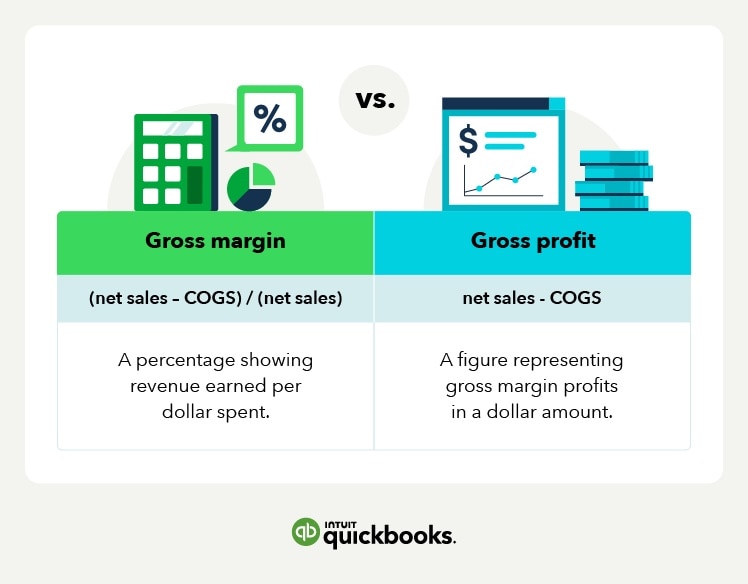

Gross Margin

You work it out by dividing your contribution margin by the number of hours worked on any given machine. If the annual volume of Product A is 200,000 units, Product A sales revenue is $1,600,000. Thus, the concept of contribution margin is used to determine the minimum price at which you should sell your goods or services to cover its costs.

That said, most businesses operate with contribution margin ratios well below 100%. It is important for you to understand the concept of contribution margin. This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs. The contribution margin ratio is expressed as a percentage, but companies may calculate the dollar amount of the contribution margin to understand the per-dollar amount attributable to fixed costs. Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs. Profit is any money left over after all variable and fixed costs have been settled.

One of the most critical financial metrics to grasp is the contribution margin, which can help you determine how much money you’ll make by selling specific products or services. Yes, the contribution margin will be equal to or higher than the gross margin because the gross margin includes fixed overhead costs. The contribution margin excludes fixed costs, so the expenses to calculate the contribution margin will likely always be less than the gross margin. Break even point (BEP) refers to the activity level at which total revenue equals total cost.

As a percentage, the company’s gross profit margin is 25%, or ($2 million – $1.5 million) / $2 million. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights. On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company. For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit.

The gross sales revenue refers to the total amount your business realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances. Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows. For instance, you can make a pricier version of a general product if you project that it’ll better use your limited resources given your fixed and variable costs. If a company has $2 million in revenue and its COGS is $1.5 million, gross margin would equal revenue minus COGS, which is $500,000 or ($2 million – $1.5 million).