Banking companies will find possibilities to then grow the renewable property as a consequence of brand new standards devote the fresh new European union Taxonomy’s ecological delegated operate (such as to help with the newest game savings), but weather transform minimization will continue to be the primary driver to eco-friendly also have. ESG redemption costs commonly go up out of 15bn to 34bn. This can also release alternative assets for new ESG have, however, probably not with the full number as a result of the change built to a few of the green bond eligibility standards because the securities was indeed awarded.

The latest ESG also provide by the insurers and other economic attributes companies (excluding home) is only going to add 5bn toward ESG full, this present year and then.

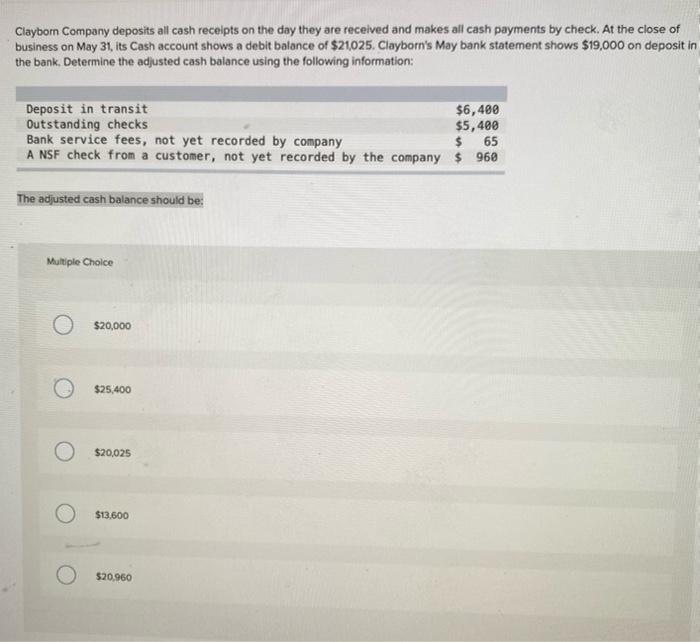

Lower issuance amounts by banks often correspond that have shorter ESG supply

Since next season, people can also choose to topic the eco-friendly securities under the Eu green bond fundamental. Due to the reasonable first green resource proportion (GAR) disclosures by banking companies this current year, we doubt we will see a good amount of bank bond also provide not as much as it practical. Judging, including, the reduced reported Eu Taxonomy alignment of home loan lending guides out-of banking companies, few banking companies can marshal a sufficiently high portfolio out of taxonomy-lined up possessions so you can substantiate green issuance underneath the Eu GBS style. That’s except if they are comfortable adequate into the progress candidates of its taxonomy-aligned property.

A property thread also have has actually exceeded the requirement so far which seasons, having total -denominated a property issuance within 19bn as of . We’d initial anticipate a supply of 15bn toward season, which had been already a massive improve compared to 2023 (8bn). But not, also have could have been also stronger than asked, with many organizations capitalizing on boosting capital .

We expect supply to get meaningfully again inside the 2025, pencilling in the 30bn for real house. Whenever you are 30bn is much more than in recent times, it’s still a lot below 2020 and you may 2021, and more in accordance with 2018 and 2019. We see five reasons for the increase:

- Redemptions begin to pick up.

- Exchange quantities will probably boost.

- Bond sector criteria increase for much more issuers.

- Home transforms the brand new part.

- Eco-friendly thread also provide stays good.

Getting 2024, redemptions and gives are prepared are generally similar, towards possibility of websites also have as somewhat self-confident. So it follows the new -11bn away from web negative likewise have inside 2023 2400 dollar loans in Boulder CO, a genuine outlier while the graph less than reveals. For 2025, we feel the web positive have is c6bn, that’s nevertheless lower in a historical framework.

The important cash accounts towards guides many corporates (on account of high financial support finished in 2019-21) had been depleted, which means the fresh new boundary is gloomier and a lot more financing is generally expected.

I in addition to assume more hybrid supply getting inspired in part from the get defensive, while the numerous circles reveal that their score migration stats try already weak, and you will capex is actually likewise on the rise, all the at once out-of poor consumer consult. To keep within this get perimeters, new temptation so you can question much more otherwise new hybrids tend to trigger have.

Our very own standard would be the fact very banking institutions seek to refinance after that calls rather than stretching the a fantastic profit. In addition, we expect banking companies to carry on for taking a careful approach to refinancing approaching phone calls the coming year also. Finally, the choice to phone call is obviously determined by the industry background going closer to the phone call time specifically because of the issuer (and in some cases bond) insights.

EUR bench

I anticipate a business ESG source of 130bn in 2025. That have corporates issuing a total of c.400bn the coming year, ESG bonds often show 33% out of complete supply, right up out of 31% in 2024F.

I browse again getting some faster ESG likewise have by banking companies into the 2025 compared to seasons just before, which have 2025 ESG issuance requested from the 70bn. Regarding the matter, 80% is to be issued inside the eco-friendly format. Banking companies are projected to help you print 20bn quicker overall (vanilla extract along with ESG) and you can lending increases is determined to pick up only gradually 2nd year. And this, alternative mortgage portfolios will grow moderately.