There are two main particular FHA 203(k) financing. An elementary 203(k) loan is used for more detailed home improvements one meet or exceed $35,000, and architectural repairs and you can major renovations.

FHA Framework Financing:

FHA structure fund are specially for new construction otherwise nice treatment out of an existing possessions. It funds the building stage and you can automatically move it for the an excellent permanent FHA home loan immediately after build is finished.

This can be a-one-day romantic (OTC) techniques in which discover only 1 application and one closing to possess both construction mortgage plus the permanent financial. A supplementary importance of this mortgage is the fact an enthusiastic FHA-acknowledged creator otherwise builder are going to be hired exactly who suits FHA construction standards. Think about other new house structure funds out-of individual money and you can collection lenders.

New FHA structure so you’re able to long lasting financing merges the advantages off an excellent short-name build loan with that from a standard, personal loans online North Carolina long-title FHA financing.

Based on FHA laws and regulations, the bank need to approve the specialist you have chosen to create your home. After accepted, your own FHA acknowledged bank can establish a suck agenda into the loan according to research by the estimated build timeline. With each mark, the builder would-be paid to ensure the extension of your construction techniques.

Following framework is finished, the lending company will move brand new small-label construction financing for the a long-term mortgage, normally having conditions long-lasting 15 in order to 3 decades. You will then create typical monthly obligations before the loan try paid down.

Ideas on how to Get A keen FHA Structure Financing?

There are lots of actions doing work in applying for a keen FHA framework mortgage. Let’s examine all of them:

See an enthusiastic FHA Framework Mortgage Financial

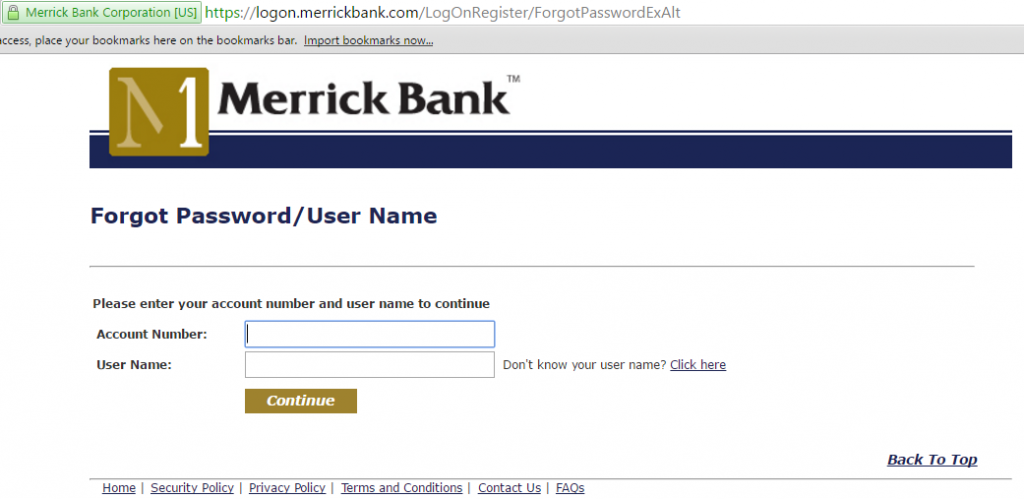

First thing is to find recognized FHA build loan loan providers. For this, you can certainly do your hunt online nevertheless the really real is to refer to HUD’s financial record and appear for the condition. The fresh recognized FHA design loan providers is indexed here and you can effortlessly obtain them.

FHA Framework Financing Requirements

The next action would be to check if you meet the eligibility standards to have an enthusiastic structure funding. This may involve checking credit score, money confirmation, and you will DTI ratio criteria of your county. Consult with the lender knowing the certain standards and you will direction.

- Driver’s license and other appropriate ID we.e. passport

- Taxation statements

- W-2 Models

- Financial comments for the past two months

- Statements for other quick assets

- Authored confirmation out of work (VOE)

- Credit file

- Buy Contract or Design Bargain

- Appraisal Statement

Favor a keen FHA-Accepted Creator otherwise Builder

Getting FHA construction financing, you should work at a keen FHA-accepted builder otherwise company to ensure they follow FHA design requirements and you will guidance.

Get the Financing Form of Off numerous FHA design fund, buy the variety of FHA build mortgage one is best suited for the requires, we.elizabeth. FHA 203(k) fundamental, minimal, or FHA framework mortgage.

Submit the application Once checking out the more than process, anybody can submit the application. Understand a little more about the brand new FHA build financing and you will techniques, visit here.

Qualifications Criteria to possess FHA Build Lenders

According to FHA construction loan guidelines, there’s a collection of qualifications requirements this package needs to satisfy to get a part of which loan system. The fresh new eligibility criteria are listed below

It is recommended for a credit rating off 580 or a lot more than, with this specific you’ll be able to only be required to create an advance payment of just step 3.5%. Yet not, even after a get anywhere between five-hundred and you can 579, you may still qualify for an FHA loan. Although decrease the credit rating, the greater are the down-payment, on occasion increasing doing 10%.