- Shortly after discussing the price, you would have to pay the choice commission so you can support the Solution to Purchase (OTP) about seller. So it offers the personal right to purchase the assets in this a designated several months.

- Obtain an out in-Concept Approval (IPA) out of a financial and implement getting a mortgage just before workouts the fresh new OTP to be sure you have the needed funds.

- Take action this new OTP for the conformed timeframe, sign product sales and get Arrangement, pay the balance deposits, and you can done all of the legal conformity to help you finalise the home import.

Immediately after far effort, you’ve eventually located your perfect family with the resale field. You can not waiting to remodel your house and you will move in, however, several tips are expected anywhere between protecting the choice to buy (OTP) and to-be the dog owner. Keep reading to ascertain what has to takes place one which just get the important factors in your hands.

An option to Pick (OTP) try a legal bargain when you look at the a home one to features a buyer new personal straight to buy property inside a designated months (normally 2 weeks to possess personal services and you can step three weeks to own HDB) , in return for an option percentage. Whether your customer does not do so it best in the solution period, the seller provides the to forfeit the option commission s and you will re-listing the property for sale.

step one. Procuring the newest OTP

Adopting the price negotiation, the vendor (or their appointed representative) continues to help you situation the option to purchase (OTP). A keen OTP are a contract one, pursuing the commission of your own choice fee, offers a substitute for the mark customer to find the house at the an assented rates inside an assented several months (generally speaking 14 days, although this years is going to be worked out amongst the seller and the consumer).

If you are there isn’t a recommended guide to the exact articles otherwise phrasing from terms and conditions inside an OTP, really property agencies usually use templates provided with their respective enterprises. Would carefully opinion the new words spelt away just like the income regarding the house or property will be limited by brand new contractual clauses listed in it.

To procure the OTP, you would need to afford the option percentage, always 1 to help you 5 % regarding price to possess personal belongings (negotiable) or not over S$1,000 for HDB apartments.

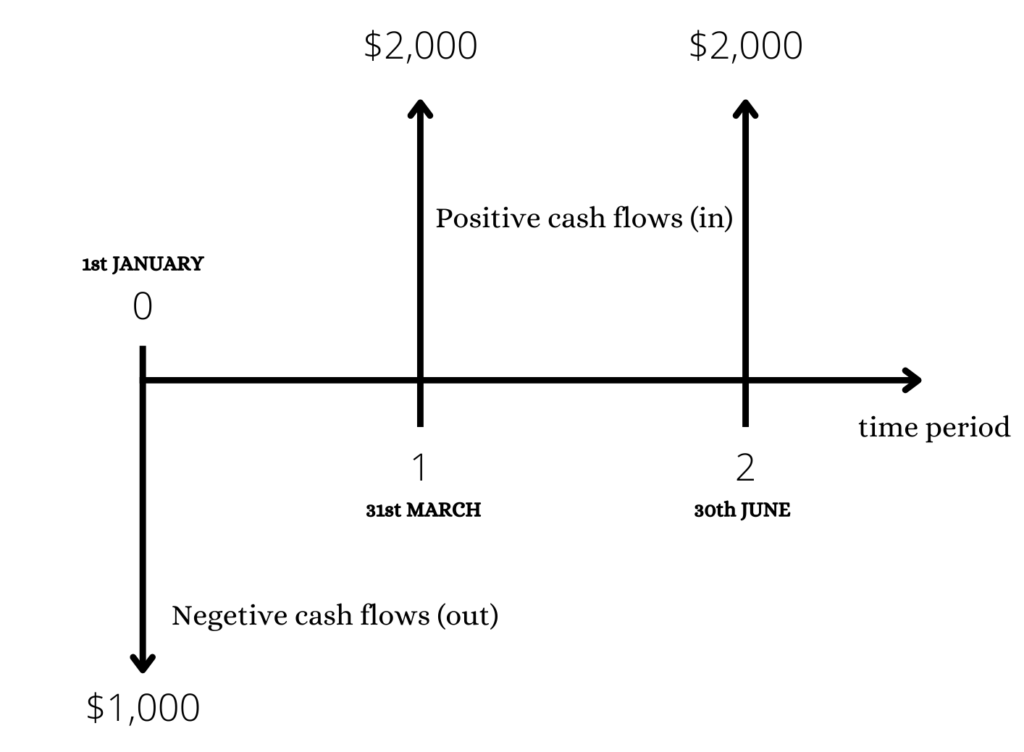

Before achieving the OTP and application for the loan levels, you really need to currently have an idea of how much cash your keeps easily accessible and your CPF -OA balance. It is good routine discover an in-Idea Acceptance (IPA) from a financial.

Without lawfully joining, protecting the fresh IPA will provide you with an offer of your quantity of financial youre qualified to receive when shopping for a house, reducing the likelihood of losing the put should you are not able to safer an interest rate.

When you put your alternative fee, make an effort to submit an application for home financing towards bank in advance of working out the latest OTP.

3. Exercise the latest OTP

Since the home loan could have been approved by the financial, buyers are able to move on to do so the fresh OTP during the given schedule, then enter into a profits and get Contract (S&P) into the vendor. Assets deals are typically regime, nevertheless the help of a lawyer to be effective towards the conveyancing and you can homework is necessary.

Included in S&P, buyers are required to move on to afford the balance put (4% from cost getting individual functions much less than S$5000 to possess HDB ). The fresh revenue would be titled regarding in the event your OTP isnt duly exercised during the given period, in addition to choice percentage was forfeited.

Remember to spend the brand new Buyer’s Stamp Obligations (BSD) (projected 3% off cost) for the government within this 14 days out-of exercise new OTP, plus Most payday loans online Alabama Buyer’s Stamp Obligations (ABSD) for folks who very own multiple assets.

Your own attorneys will likely then hotel a beneficial caveat to the property. That is an official observe interesting on possessions, stopping it out of being sold several times.

4. Pre-conclusion

Through to exercising the new OTP, you and owner would have agreed upon a romantic date out-of conclusion towards the product sales, typically in approximately ten so you can several weeks’ big date. During this time period, their appointed firm is going to run the desired checks to ensure that the possessions can be marketed having a flush term, with no other caveats lodged facing they or any encumbrances. During this time period, a proper valuation of the property may also be accomplished by the bank’s or HDB’s appointed appraiser.

By you, get ready to submit one needed records for the financial or even the authorities, to make the newest deposit as required.

I f youre playing with an enthusiastic HDB mortgage, the brand new down payment is actually 20% of price, that’s paid back using cash, CPF Typical Account (OA) savings, or both. By using a bank loan, the latest deposit is actually 25% of the purchase price, which have at least 5% required in dollars together with left 20% having fun with sometimes cash and/ or CPF OA deals.

Enough time pit allows the seller to maneuver out from the possessions, whenever they haven’t already, also to make sure that dated seats is actually discarded, otherwise assented solutions done. That it without a doubt hinges on the brand new concurred sales conditions when you’re purchasing the assets into the as-in status or vacant hands.

In the end, at the time regarding end, make a visit to the lawyers’ place of work for which you might be theoretically inserted because pleased the manager of the property. At this point, their lawyer will have already implemented abreast of moving the remainder 95% for the supplier, enabling you to collect new keys to your dream household.

Carry out remember that one restoration charges, property fees or any other fees of the property usually takes effect from this day of conclusion.

With these past stages in lay, you can start any need restoration and begin converting new newly ordered device in the fantasy domestic.

Initiate Planning Now

Below are a few DBS MyHome to sort out the new amounts and acquire a house that suits your budget and you may preferences. The best part it slices the actual guesswork.

Alternatively, get ready having an out in-Principle Recognition (IPA), and that means you features certainty about precisely how much you might obtain to possess your house, allowing you to know your budget truthfully.