Predatory credit also can use the variety of car and truck loans, sub-best fund, home collateral finance, taxation reimburse expectation financing or any sort online installment loan OR of individual debtmon predatory lending methods are faltering to disclose pointers, exposing false information, risk-built pricing, and you can exorbitant charge and you will costs. These strategies, often in person or whenever shared, would a cycle regarding debt that triggers big financial hardship to have families and individuals.

You really have selection

When you’re up against financial obligation difficulties, you are able to think that these loan providers is your own simply option. Not the case-you have a lot of choices so you’re able to taking out a high-rates mortgage:

- Percentage package that have financial institutions-An educated alternative to payday loans is always to package individually having the debt. Workouts a long commission package with your loan providers will get succeed that pay the delinquent debts more a longer time of energy.

- Get better from your company-Your employer might be able to give your a paycheck get better when you look at the an emergency condition. Because this is a real progress rather than that loan, there won’t be any attention.

- Borrowing commitment loan-Borrowing from the bank unions generally speaking render affordable quick brief-term money in order to members. In place of payday loan, these financing give you a bona-fide possible opportunity to pay back which have extended payback episodes, down interest rates, and you will installment payments.

- Credit guidance-There are many different credit rating guidance businesses throughout the You that may help you workout a loans installment plan that have creditors and produce a budget. These services arrive from the little costs. The brand new National Foundation having Borrowing from the bank Guidance (nfcc.org) is actually an effective nonprofit team that will help you pick an established specialized credit counselor close by.

- Emergency Assistance Applications-Of several community groups and you can trust-situated groups render emergency guidelines, sometimes physically otherwise by way of societal attributes apps getting weather-associated issues.

- Cash advance on your own credit card-Bank card payday loans, which can be usually available at an apr (APR) away from 30% otherwise less, are a lot cheaper than bringing a quick payday loan. Some credit card companies focus on customers that have monetary dilemmas or poor credit histories. You will want to shop around, plus don’t believe that you don’t be eligible for a cards credit

At some point, you have to know that you will be in control, even if you end when you look at the financial difficulties. There are numerous alternatives to get rid of high-prices borrowing of predatory lenders. Take care to explore your options.

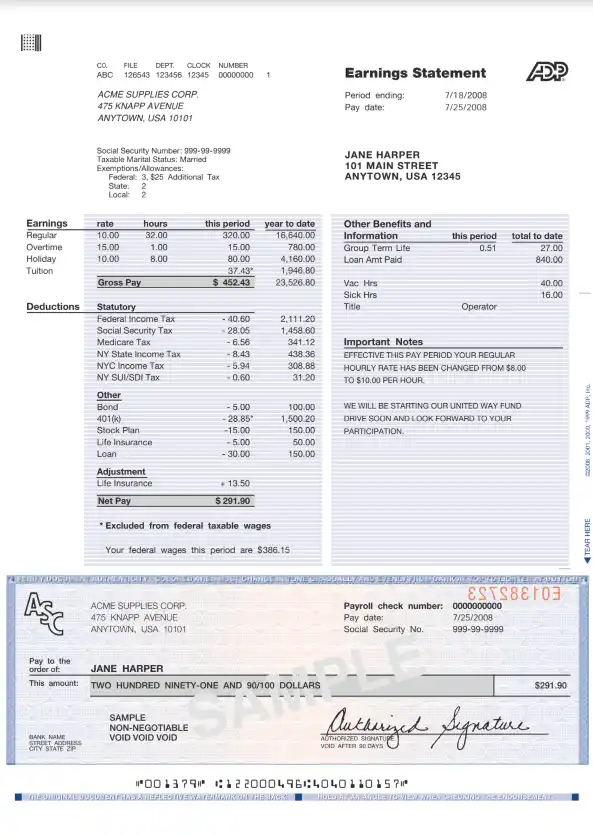

All the loan providers need comment your data just before granting that loan

Is this short article helpful? Visit our very own It is A loans Situation home page for lots more brief clips and you may of use content so you can add up of one’s money, you to thing at a time! View back, the fresh information was introduced continuously.

Rundown and you can unused home ? brand new inescapable result of predatory lending ? wreck havoc on areas. Property values slip. Anyone move aside. Immediately following tough neighborhoods beginning to break, upcoming crumble. Something that has been so important having more and more people lays during the ruins. Men who stayed in a district forgotten by predatory financing gets a sufferer.

Aggressive solicitations. Did some one sell for you? Be suspicious regarding anybody who came to your attempting to sell you financing. If you want a loan, shop around for it your self.

Balloon Costs – A common predatory habit is to render an effective bower that loan that have straight down monthly premiums having a huge payment owed within avoid of one’s mortgage identity. Generally, an effective balloon payment is more than 2 times the fresh new loan’s mediocre monthly payment, and sometimes it can be tens and thousands of dollars. Repeatedly such balloon repayments try hidden regarding the package and regularly hook borrowers by the shock.

While you are given that loan to the pledge up front that you’re going to feel approved, become very cautious. When you are provided a loan no down payment, always see the regards to the mortgage along with whether or not there will be a first mortgage an additional loan which have some other rates while you might be necessary to pay for mortgage insurance coverage?

While the predatory fund usually are secured loans, the financial institution possess something to acquire if the borrower defaults. Therefore, by the tricking a person into taking right out that loan getting an effective domestic they can not pay for, a lender will have money for an occasion and you will next have the assets straight back throughout the property foreclosure and sell they to possess income.

- Mortgage sharks is actually someone or organizations which offer fund at the very highest rates. The term always means illegal interest, but may together with reference predatory financing pursuits like payday or title loans. Loan sharks possibly impose payment by the blackmail otherwise risks out-of physical violence.