What is a good Va Loan?

Created in 1944 of the United states authorities, the newest Virtual assistant loan is one of the most novel and you can strong financing programs previously dependent. S. Department off Veterans Factors (VA). The new Va mortgage was created to let coming back service players with the acquisition regarding a home without needing a down payment otherwise advanced level borrowing.

Virtual assistant Financing Qualifications

The new Va ‘s the final power into the eligibility towards the home loan program, although first qualification recommendations affect energetic duty services participants, Federal Shield members, reservists, and you may veterans. Partners of army members exactly who died to your effective responsibility or while the a result of a support-connected impairment may also be eligible.

To become entitled to good Va Mortgage, you need to satisfy no less than one of the adopting the conditions:

You are the mate out-of a support affiliate who has died about type of duty otherwise down seriously to good service-related handicap.

Additional Qualification Conditions

The brand new Va is the final authority towards eligibility. not, the private Va financial you select will also have an additional set of requirements you need to satisfy in addition to personal debt, money, and you can credit standards. Once you get your loan, your own bank commonly remove your credit score about around three top credit bureaus, as well as examine your financial obligation-to-earnings proportion. It is also important here to refer one an experienced applying having a great Va mortgage must not were discharged less than dishonorable conditions.

Ideas on how to Submit an application for an excellent Va Financing

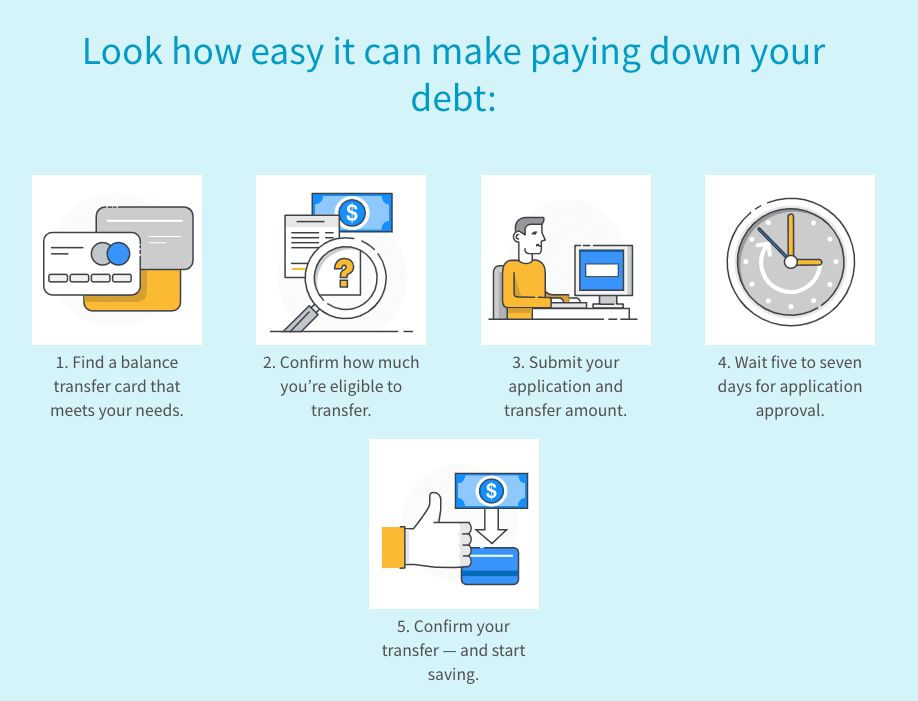

Brand new Va mortgage techniques needs 31 so you can forty five months shortly after you are significantly less than package on a house purchase. Keep in mind that the application getting a beneficial Va financing does not obligate your to complete the mortgage that have a certain bank or even to complete the home pick. Listed here is an easy self-help guide to brand new five steps to apply for a beneficial Va financing:

1. Have a look at Virtual assistant financing qualification standards above 2. Contact an excellent Va acknowledged bank and commence the Virtual assistant loan application.

3plete their Va Certification off Eligibility through the connect offered significantly more than otherwise which is often available with your financial. 4plete your loan app and supply all the needed paperwork towards the lender, plus W-2s, state and federal tax statements (if the appropriate), and you will present financial statements.

Virtual assistant Loan Certification from Qualifications (COE)

The Virtual assistant mortgage certification out-of eligibility try an important file. You could start the loan techniques which have an approved Virtual assistant lender, but you will you want a good Virtual assistant Loan Certificate till the loan are funded. The COE verifies your length and reputation off service make you entitled to make use of the Virtual assistant financial work for.

- Implement because of a great Virtual assistant recognized financial

- Apply on the web through the VA’s eBenefits webpage.

- Apply of the mail with Va Form 26-1880.

The brand new Virtual assistant mortgage certificate away from eligibility requires not absolutely all minutes to accomplish and you will assurances your home financial support moves send rather than delays. To-do the shape, please note that you will you prefer evidence of the military service.

As to the reasons Like good Virtual assistant Financing?

Va finance require no down payment or individual mortgage insurance. They provide competitive cost and you will terminology and enable licensed borrowers to help you get property with little money out of pocket.

No Down-payment RequiredWith a Va financing, a professional customer normally acquire 100% of your residence’s well worth rather than getting down an individual buck. The latest graph below will bring samples of down-payment discounts when using a good Virtual assistant loan.

Competitive Focus RatesThe interest charged for the a mortgage loan are in line with the chance presumed by financial to invest in the latest mortgage. Since the Va loans try supported by the fresh Va that have a hope, loan providers bring shorter chance and certainly will give rates which can be generally speaking .5 to one % less than old-fashioned rates of interest. New chart less than will bring an example of the brand new deals into an excellent 10% off mortgage over a 30-seasons financing several months.

- Basic Allowance having HousingLenders include your own Very first Allotment to own Housing (BAH) since energetic money, so you are able to use BAH to expend certain otherwise every their monthly mortgage can cost you.

- No Pre-Percentage PenaltyLenders take advantage of funds from financing once you create your mortgage repayments as high as the end of the expression. The new pre-commission penalty are a method to have financial institutions to recover some of that money should you decide to pay off the home loan loan early. The latest Va loan allows consumers to repay their property loan any kind of time part without having to worry on a beneficial pre-percentage penalty. Its lack of a beneficial pre-commission punishment makes you imagine upcoming domestic purchases and you can refinancing possibilities without any a lot more punishment debts.

First time Home buyers

To find a home any kind of time reason for life is enjoyable, your very first residence is fascinating and you can a studying techniques all at the same time. Normally, the most important concern an initial-time home customer requires by themselves was Exactly what do I afford? There are many issues you to determine what a good homeloan payment is going to installment loans online New Mexico be for an individual otherwise pair, and additionally yearly earnings, current personal debt costs, down-payment (when the appropriate), while the a lot more citizen costs, including insurance coverage and you will HOA charges. Your own lender will help you to easily determine the fee that helps to make the extremely feel for the budget, and when you to payment is famous, we could back once again to the price assortment that produces the new extremely feel to you personally.

Refinancing having an effective Virtual assistant Mortgage

New Virtual assistant Mortgage system provides qualified people which have an easy way to benefit from straight down rates and you will disappear the monthly mortgage payment. As well, armed forces people could possibly get cash return on the an effective Va refinance and you may utilize the continues for a variety of means, out-of paying down loans to making home improvements. One or two head programs help Va consumers so you can refinance to a lower life expectancy rate:

- Va Streamline RefinanceOften titled good Streamline re-finance, the speed Avoidance Refinance loan (IRRRL) option is just the thing for existing Virtual assistant loan owners who happen to be lookin to see tall discounts and take benefit of straight down interest levels.

- Cash-Out RefinanceA cash-out refinance are an option for those with good Va or conventional mortgage trying make use of their house’s security to access bucks to possess home improvements, problems, pay off personal debt, or any other objective.

Va Refinance Qualifications

For individuals who offered for the productive obligation for over 90 straight weeks throughout the wartime or higher than just 181 days of provider through the peacetime, you could generally speaking qualify.