Financing Words having Non-Forgivable Balance Non-forgivable financing balances is payable more a-two-year term with an interest rates of 1%

The fresh new Income Safeguards Program (PPP) try a good $349 billion national mortgage and you will grant system to simply help brief people are solvent and keep personnel inside the COVID-19 pandemic.

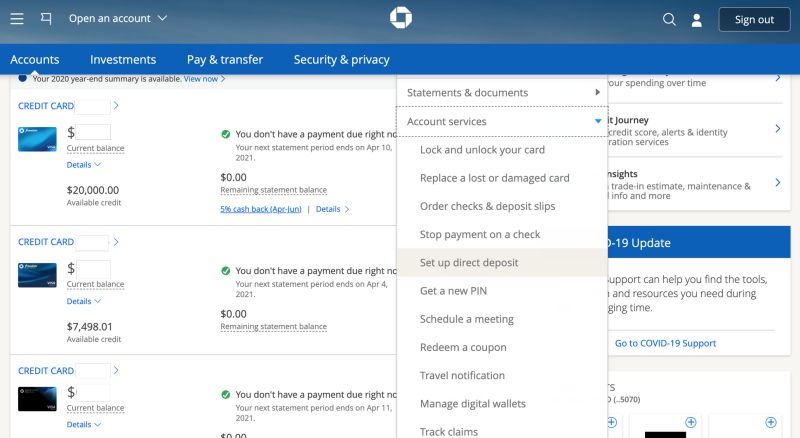

- The PPP is actually administered from the Small business Government seven(a) loan program. People need certainly to manage a medication SBA bank (lender, borrowing commitment, and other acknowledged financial) to try to get PPP loans.

- Smaller businesses and you may only proprietorships . Independent builders and you may worry about-working somebody .

- Not as much as latest law, the newest PPP system will cease taking programs on is the reason lending power limit is actually attained, almost any is sooner.

Who can get an effective PPP Financing? Companies having under 500 workers are permitted submit an application for PPP financing. Form of organizations were only people, independent designers, self-operating anyone, 501(c)(3) charities, veterans’ services groups, and certain Tribal enterprises. Most of the candidates ought to provide files indicating this new applicant is actually operational earlier in the day to .

Qualified entities tend to be 501C3 and you may experienced-relevant non-profits and smaller businesses (below five hundred staff). Read More