As to the reasons its unwise to possess basic-home buyers and you will mortgagors to change jobs

This will keeps unintended effects, brokers warn

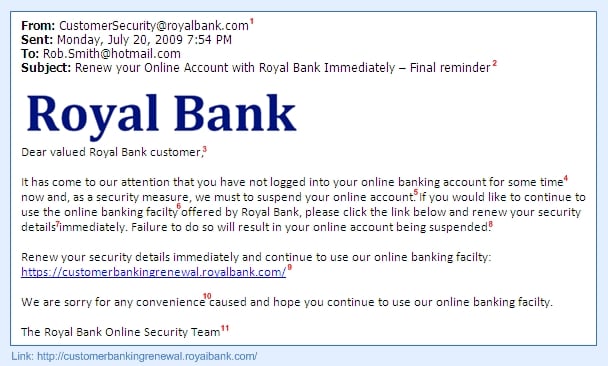

First-home buyers and you will mortgagors hoping to get that loan or refinancing is to lay their earnings manageable before making occupation transform, brokers possess advised.

Chris Foster-Ramsay, Foster Ramsay Finance director, told you lenders were really worried about occupation change, as these improved the possibility of defaulting to your that loan.

It might be foolish are searching for money acceptance otherwise to acquire and get a house if you are altering job jobs in one way or any other, Foster-Ramsay advised The Questionnaire Early morning Herald.

Stephen Tuffley, Seek director regarding sales and you may services, said the start of the season is actually the brand new busiest several months getting changing services.

Close to the end out-of January and you may March is simply the height time for individuals lookin on our sites, Tuffley told you.

Predicated on Look for research, nearly three quarters out-of Australians were accessible to modifying work at one-point, especially thus to have younger Australians, Tuffley said.

To approve yet another mortgage otherwise refinancing, loan providers constantly require around around three time periods off payslips, or maybe more getting casuals. Read More